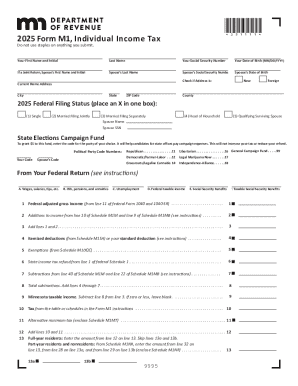

MN DoR M1 2011 free printable template

Instructions and Help about MN DoR M1

How to edit MN DoR M1

How to fill out MN DoR M1

About MN DoR M1 2011 previous version

What is MN DoR M1?

Who needs the form?

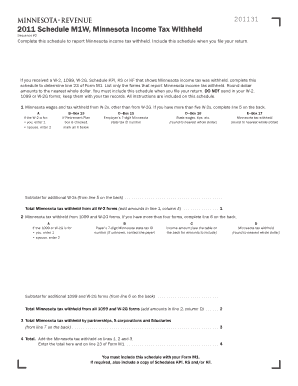

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about MN DoR M1

How can I correct mistakes after submitting my 2011 mn form?

If you discover an error after submitting the 2011 mn form, you can file an amended version to correct the mistake. Make sure to clearly indicate the changes and provide any necessary supporting documentation to avoid processing delays.

What should I do if I have not received confirmation of my 2011 mn form submission?

If you haven't received confirmation of your 2011 mn form submission, it's essential to verify the submission status through the e-filing platform or contact the relevant department directly. Tracking details can often help identify any issues that may have arisen during processing.

Are there any specific privacy concerns I should consider when filing the 2011 mn form?

Yes, when filing the 2011 mn form, consider the privacy and data security measures in place. Ensure that all sensitive information is transmitted securely, and familiarize yourself with data retention policies to understand how your information will be handled.

What common errors should I avoid when submitting the 2011 mn form?

Common errors in the 2011 mn form include incorrect taxpayer identification numbers, missing signatures, and discrepancies in reported amounts. Double-checking the information before submission can help reduce the risk of rejection or processing delays.

Can I e-file the 2011 mn form using mobile devices?

Yes, the 2011 mn form can typically be e-filed using mobile devices; however, compatibility may vary by software. Ensure that your mobile browser meets the technical requirements for a smooth filing experience.

See what our users say